Parliament on Thursday evening approved the National Budget Framework Paper (NBFP) for the Financial Years 2026/27 after an extensive debate on the report of the Committee on Budget.

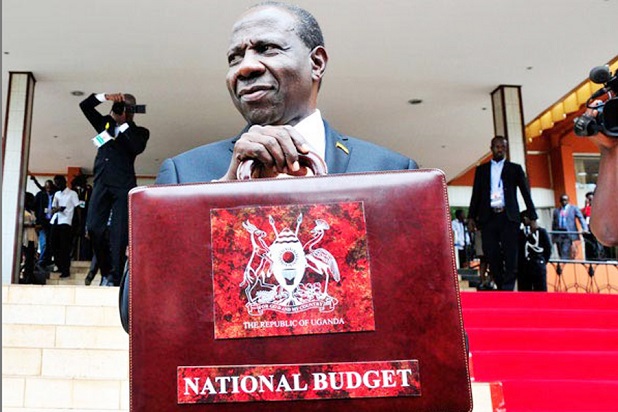

Presenting the government’s position, the Minister of State for Finance (General Duties), Henry Musasizi, said the strategic policy direction for the next financial year and the medium term is anchored on delivering tenfold economic growth, with the goal of expanding Uganda’s economy to USD 500 billion by 2040.

Musasizi told Parliament that the government will prioritise investment in key growth sectors under the ATMS and Enablers framework, alongside a strong push for export growth, to accelerate socio-economic transformation. He added that the economy is projected to grow between 6.5 per cent and 7 per cent in FY 2026/27.

In line with the strict timelines set out in the Public Finance Management Act (PFMA), Cap 171, the minister pledged the Finance Ministry’s full support to Parliament to ensure that the FY 2026/27 budget is processed by the end of April 2026, ahead of the inauguration of the 12th Parliament.

Musasizi outlined a number of priority actions Government will focus on in the next financial year, including stamping out budgetary practices that breed corruption, closing leakages in routine expenditures such as transfers to schools and health centres, and strengthening payroll management.

Other key focus areas include improving cash and liquidity management, enhancing Uganda’s sovereign credit ratings, diversifying sources of development finance through innovative instruments, strengthening internal controls and audit functions, and completing public procurement reforms.

The government also plans to improve the management and maintenance of public assets, increase domestic revenue mobilisation, strengthen governance and supervision of state-owned enterprises, and address challenges affecting project execution, including low absorption of borrowed funds and inadequate counterpart funding for externally financed projects.

Musasizi further said the government will strengthen the capacity of the Uganda Bureau of Standards (UNBS) to improve certification of products for both export and the domestic market, enhance performance management in the public service, improve coordination across government, and clear the existing stock of domestic arrears while preventing the accumulation of new ones. He noted that a strategy is already in place to eliminate the current arrears stock over three financial years starting in FY 2025/26.

According to the Ministry of Finance, the preliminary resource envelope for FY 2026/27 stands at Shs 69.399 trillion, down from Shs 72.376 trillion in FY 2025/26. Domestic revenues are projected at Shs 40.090 trillion, up from Shs 36.806 trillion in the current financial year.

Government discretionary funding, net of arrears, interest payments and domestic debt repayments, is projected at Shs 31.059 trillion, compared to Shs 32.480 trillion in FY 2025/26. Domestic borrowing is expected to reduce to Shs 8.952 trillion, down from Shs 11.381 trillion, while domestic debt refinancing is projected at Shs 9.68 trillion, also lower than the Shs 10.028 trillion projected for the current year.

External budget financing is projected to decline sharply from Shs 2.084 trillion in FY 2025/26 to Shs 330.97 billion, while external project financing is expected to reduce to Shs 10.018 trillion from Shs 11.327 trillion.

The FY 2026/27 budget will be financed through a mix of domestic and external resources, including tax revenues, loans and grants. The government will prioritise concessional borrowing for social projects and leverage innovative financing with competitive terms for high-return infrastructure investments.

Musasizi said the government will also reprioritise resources within the current fiscal framework to improve efficiency, intensify efforts to boost domestic revenue mobilisation, attract foreign direct investment, and maintain sound fiscal and monetary policies to safeguard macroeconomic stability and improve Uganda’s credit ratings.